For precise tax estimates, especially for complex business structures, it’s advisable to consult with a tax professional familiar with Delaware tax regulations. Although not as common, the Investor Rights Agreement may also make reference to the par value of preferred shares. This document outlines the rights of the investors, including anti-dilution protections and information rights, among others.

- Total gross assets shall be those “total assets” reported on the US Form 1120, Schedule L (Federal Return) relative to the corporation’s fiscal year ending the calendar year of the report.

- If you are a startup that has chosen Delaware as its state of incorporation, you are likely aware that you are subject to Delaware franchise tax.

- The authorized share method is generally Delaware’s tax team’s default method of calculating the franchise tax, and it can result in a much higher tax bill vs. the assumed par value method.

- Remember, these numbers are to get the gears turning on how Delaware’s Authorized Shares Method can play out for different sizes of startups.

Franchise taxes for partnerships and LLCs

Provide all relevant documentation such as proof of payment and the reason for the refund request. Refunds are processed on a case-by-case basis, and approvals are not guaranteed. That’s an extra 99 chunks of 10,000 shares, each chunk costing you $85. Franchise Taxes and annual Reports are due no later than March 1st of each year. At any moment, executives or team members may own public or private stock in any of the third party companies we mention.

LLCs, LPs, LLPs

This means that you’re likely to need to pay taxes in those states. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Let’s also imagine it has authorized and issued 100,000 shares at a par value of $2.00 each, and 100,000 shares at par value of $10.00 each. Let’s also assume the number of shares issued and authorized is the same for simplicity’s sake. Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

DELAWARE ANNUAL FRANCHISE TAX CALCULATION INSTRUCTIONS

The Delaware Franchise Tax and the Registered Agent Fee are two separate, unrelated fees. The annual Franchise Tax is imposed by the State of Delaware and varies with the size of your business. The annual Registered Agent Fee is a fixed amount paid to Harvard Business Services, Inc. to act as an agent for your entity in the state. Yes, regardless of your Delaware company activity or not conducting business, you are still required to pay the Delaware Franchise Tax to remain in Good Standing. If your company is no longer active and you wish to close your business, be sure to follow the proper steps to Dissolve a Corporation, or Cancel an LLC.

These entities might include non-profit organizations, educational institutions, and certain religious organizations. Since they are exempt from the tax, it is crucial for them to comply with their annual reporting obligations. The Delaware Division of Corporations provides two methods to calculate Delaware franchise tax. The first method is based on the authorized share count, and VC-backed startups with option pools can quickly get to thousands of dollars in taxes due. The second method is the “assumed par value” method and is a more complicated formula based on shares issued and the company’s gross assets. This second method often results in lower tax bills for VC-backed startups.

How to reduce your company’s Delaware Franchise Tax

To reduce the taxes paid by a startup, use the Assumed Par Value method. When paying the annual report fee, corporations are sorted into two categories. If you don’t want to pay your Delaware franchise tax yourself, you can hire a registered agent to do it for you. The registered agent will charge a small fee to complete the filing of your Delaware franchise tax. This information is listed on the Delaware Certificate of Incorporation filed in Delaware. And one of the most popular questions we receive daily is how many shares of stock should I start my Corporation with?

If you incorporated in Delaware, yes, you need to file and pay the Delaware Franchise Tax. Most VC backed startups are Delaware C-Corps, which means that most VC-backed startups DO need to file. While our focus at Kruze is on C-Corps, it’s worth noting that Delaware has different requirements for other business structures. Limited Liability Companies (LLCs), Limited Partnerships (LPs), and General Partnerships face a June 1st deadline for their annual payments. Learn more about this deadline on Delaware’s website; this calculator may not be the best calculator for LLCs / non-C-corps. If taxes and bookkeeping are proving to be a hassle, consider looking into our complete Accounting and Bookkeeping service.

Under this method, your franchise tax is based on how many shares your corporation has authorized. Incorporating a business in Delaware comes with certain advantages. These include a business-friendly court system, flexible incorporation rules, and the fact that businesses operating only outside of Delaware don’t have to pay state corporate income tax. Now, doubtful accounts and bad debt expenses imagine all your authorised shares have a par value of less than $10 (which is pretty standard for startups), and you’re trying to calculate your franchise tax based on this method. The first is the use of virtual mailboxes, which Delaware does not accept because they require a physical address to know where your company is actually operating from.

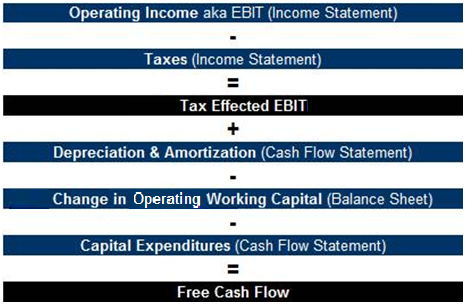

Total gross assets shall be those “total assets” reported on the US Form 1120, Schedule L (Federal Return) relative to the corporation’s fiscal year ending the calendar year of the report. The tax rate under this method is $350 (to be increased to $400 effective for the 2018 tax year) per million or portion of a million. If the assumed par value capital is less than $1 million, the tax is calculated by dividing the assumed par value capital by $1 million then multiplying that result by $350. This method calculates the tax based on your corporation’s total gross assets and the ratio of issued shares to authorized shares.

Your company will likely need to use the assumed par value calculation method instead of the authorized share method of calculation. A tax haven or shelter is a method of reducing taxable income which results in a reduction of tax payment. The method is any that recovers more than $1 in tax for ever $1 spent within a four-year period. If your business was formed or is located in another state but generates income in Delaware, you may need to pay Delaware taxes. If you own a business that operates in multiple states, you will greatly benefit from the knowledge of a tax professional. If you pay your Delaware franchise tax late, you’ll be charged a late fee.

Basically, a company pays $400 per million dollars of par value, but the way par value gets calculated is a bit complex. A corporation with 5,000 authorized shares or less is considered a minimum stock corporation. The Delaware annual https://www.kelleysbookkeeping.com/allowance-for-doubtful-accounts-and-bad-debt/ report fee is $50 and the tax is $175 for a total of $225 due per year. Assumed Par Value Capital MethodWith this method your Delaware Franchise Tax bill is calculated based on issued shares, authorized shares and total gross assets.

Prolonged non-payment can lead to the loss of good standing status or even administrative dissolution of the business entity. To get the specific calculations for your business, visit the Division of Corporations website https://www.quick-bookkeeping.net/ and follow the instructions provided. S Corporations, as well as large corporate filers, governed by the state of Delaware are subject to Franchise Tax, with different considerations for calculating the amount due.