The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. We evaluated Xero vs QuickBooks based on ease of use, pricing, and how well each performed against the ideal features we’re seeking—including project accounting, inventory management, and mobile accounting. Both Xero and QuickBooks Online do a great job of accounting for inventory and calculating the cost of your inventory sold automatically. However, inventory accounting is included in all Xero plans while it’s only in the Plus and Advanced versions of QuickBooks Online.

A/P Management: QuickBooks Online Wins

While Xero’s plans start at a cheaper price, QuickBooks offers more features across its plans. Then again, QuickBooks requires user limits for each plan while Xero doesn’t. We compared the two options in terms of their types of irs penalties key features, pricing and customer service to help you decide which is right for your business. Business owners, freelancers and entrepreneurs often spend a large chunk of time on administration and accounting.

Customer Support

Unlike some competitors that require you to pay extra for a time-tracking module, all FreshBooks plans come with unlimited time tracking. You can start a timer from within the mobile app to log hours spent on a particular project or sync data from tools like Asana and Trello. To find startup accounting software that will best serve your business at any stage, consider scalability as well as strong customer support. You will also want to choose software that uses the accrual basis accounting method for recording transactions. Here are NerdWallet’s picks for the best small-business accounting software, including why we selected each product, monthly price details and features checklists for easy product comparisons. We’ve also included a couple of solutions that nearly made our list and a few products you can skip.

How much does QuickBooks training cost?

This lets them save and comment on invoices, save their payment information, invite others to access the account and collaborate on projects they’ve been invited to view. Compared side by side, Xero is clearly the winner when it comes to features. Choosing the right accounting software plays a significant role in managing your business’s finances. Accounting software helps you complete bookkeeping tasks, track expenses and revenue, and send invoices to your customers. Two of the best small business accounting software programs are QuickBooks and Xero, which both command strong followings among accountants and business owners.

Xero and QuickBooks Online offer very similar features and functionality along with summary dashboards to measure business health. To make the decision a little easier, we’re comparing Xero and QuickBooks Online, side by side based on features, pricing, ease of use, and more. In sharp contrast with QuickBooks’ extensive language support, Xero does not offer support for languages other than English.

QuickBooks Online’s customer support is better than Xero’s since you can interact with an agent through a phone call. You can’t initiate a call, but you can submit a ticket and wait for an agent to call you. Note that fixed asset accounting isn’t part of our case study, so there are no scores. One reviewer mentioned that a critical feature missing in Xero is the inability to export expense receipts and attach them to invoices.

QuickBooks is available both online and via desktop and is ideal for businesses that outsource their accounting tasks to a bookkeeper or accountant. This is because QuickBooks only allows up to 40 users for its highest-tiered plan, and even then, some plans require every user to pay for their own account. Xero is ideal for businesses that keep a team of bookkeepers or accountants in-house.

With Xero, you get access to built-in reports with highly customizable layouts. We liked that these reports are interactive, which makes it easier for us to measure key performance indicators (KPIs). We also found it easy to apply formulas in Xero to compare our budget and actuals side by side. More than 750 app integrations, including live, in-house bookkeeping. Many or all of the products featured here are from our partners who compensate us.

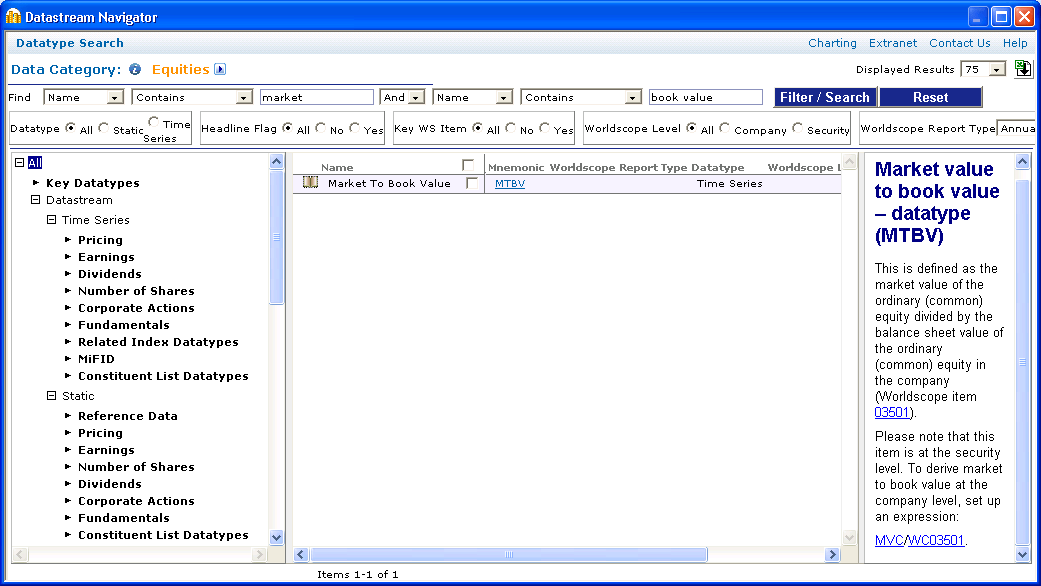

Reporting is one of the most significant Accounting Software elements for guiding Financial Strategy and Progress for your firm. As a result, when comparing Xero vs QuickBooks Online, be sure the solution you choose provides the Reporting features you require. The Bank Balance should ideally be pulled https://www.intuit-payroll.org/ straight from the bank, therefore Xero’s Bank Feed features aren’t as appealing as QuickBooks Online’s. You must return to the Chart of Accounts, add the account, and then come back and add the Transaction from Online Banking. Xero and QuickBooks Online differ when it comes to Adding a New Account.

We also like that you can use Xero to set recurring bills, generate billing reports, and store and organize all your bills. This makes the tool as great for payment as for understanding your cash outflows. Plus, https://www.kelleysbookkeeping.com/federal-insurance-contributions-act-fica/ you get bill pay tools no matter which package you choose, although you can only pay five bills per month with the Early plan. We were especially impressed with Xero’s built-in Gusto payroll integration.

- SummaryThere’s a lot to think about when comparing and choosing accounting software for your business, and not only the monthly cost.

- QuickBooks offers a main dashboard that can be customized with a series of tile-like graphs or lists, which lets you see real-time KPIs at a glance.

- All QuickBooks pricing packages include automatic expense importing and categorization.

- Keep in mind that these services charge a fee to process payments (usually around 2.9% plus 25 cents per transaction, though this varies by the payment processor).

On the flip side, there are some complaints about limited income and expense tracking categories. If your business has varied operations, you might prefer QuickBooks, as it offers more flexibility in tracking financial activities. For instance, you can track income and expenses by classes and locations.

However, QuickBooks offers a more seamless experience for two big reasons. First, QuickBooks has phone support while Xero does not, so QuickBooks users can solve their problems that much faster. Second, QuickBooks offers some features that Xero doesn’t have, like document scanning. That said, Xero has a lower price point, starting at $13 per month, compared to QuickBooks’ $30 per month starting cost, and Xero offers more integrations than QuickBooks as well. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software.

Least expensive plan lacks double-entry accounting reports, bank reconciliation and accountant access. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. In the battle of FreshBooks vs. Xero, we don’t think one is the ultimate winner. FreshBooks is the go-to solution for freelancers and solopreneurs who want freedom with managing and billing their clients.

While searching for accounting software, you might also come across something called QuickBooks Online Essentials. This is a different product than the ordinary accounting software, and it’s specially designed for service-based businesses which invoice for their time. With this tool, you can automate invoices on a recurring schedule, track income and expenses and pay multiple vendors at the same time. The solution’s comprehensive and user-friendly invoicing and reporting features impressed us. Along with essential invoicing features, you get access to the vast QuickBooks network — if your clients use QuickBooks, transactions are especially easy.